Straight-up social science that makes a solid case for changes that will never ever happen in the current political climate.

Straight-up social science that makes a solid case for changes that will never ever happen in the current political climate.

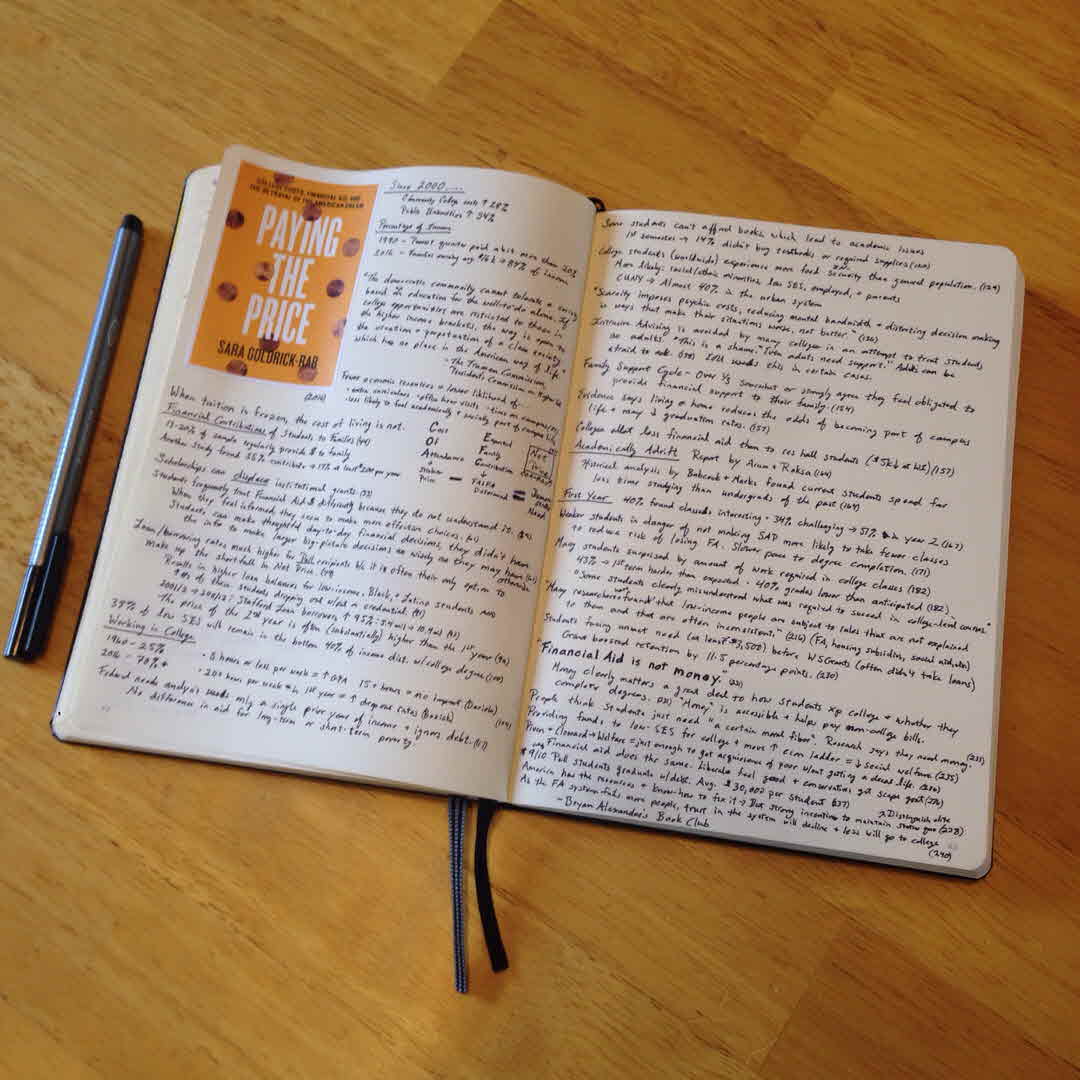

9 out of 10 Pell Grant students graduate college with debt. The average debt for these students is $30,000. Pell students are often those with the most financial need. Our financial aid system is broken & Rab explains why with lots of research & detail. This is a good book for students, parents, educators, student affairs staff, & more. It's an important read that dispels misconceptions. Also, hard to condense to 2 pages of notes! #bulletjournal

I started reading Paying the Price for Bryan Alexander's online book club (link below). The second part of this book's title is "College Costs, Financial Aid, and the Betrayal of the American Dream." So far, this book mirrors my experiences working with mostly low income students at my institution. Students are too busy working to provide for themselves & their families to be involved beyond class time. This impacts academics & retention.