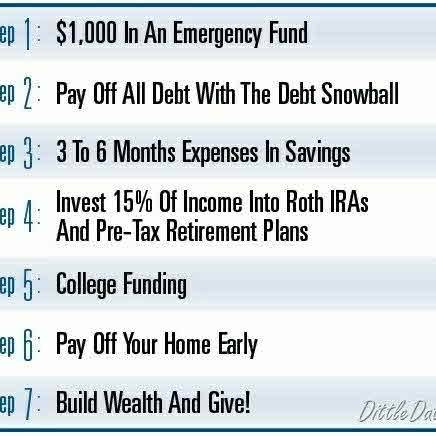

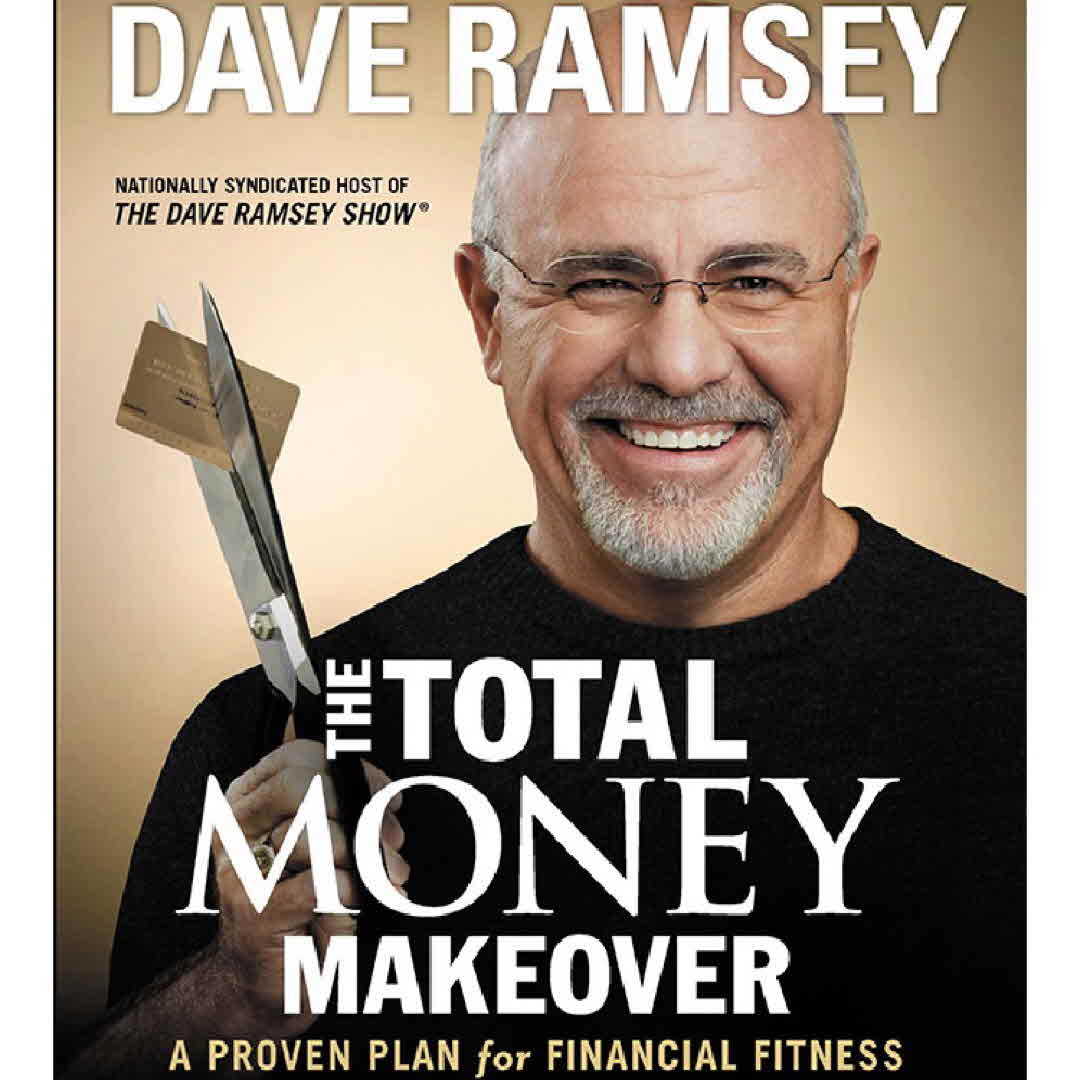

I don't doubt that Dave Ramsey's plan works. I think if I'd read his Baby Steps first, instead of the “motivational“ pep talk at the beginning, I would have enjoyed this much more than I did. I made it through about 80 pages and decided to skip the rest in favor of his budget app (which I like!). Unless you enjoy this kind of tough-love approach, that's what I would recommend.

Full review here - https://www.goodreads.com/review/show/4191025413.